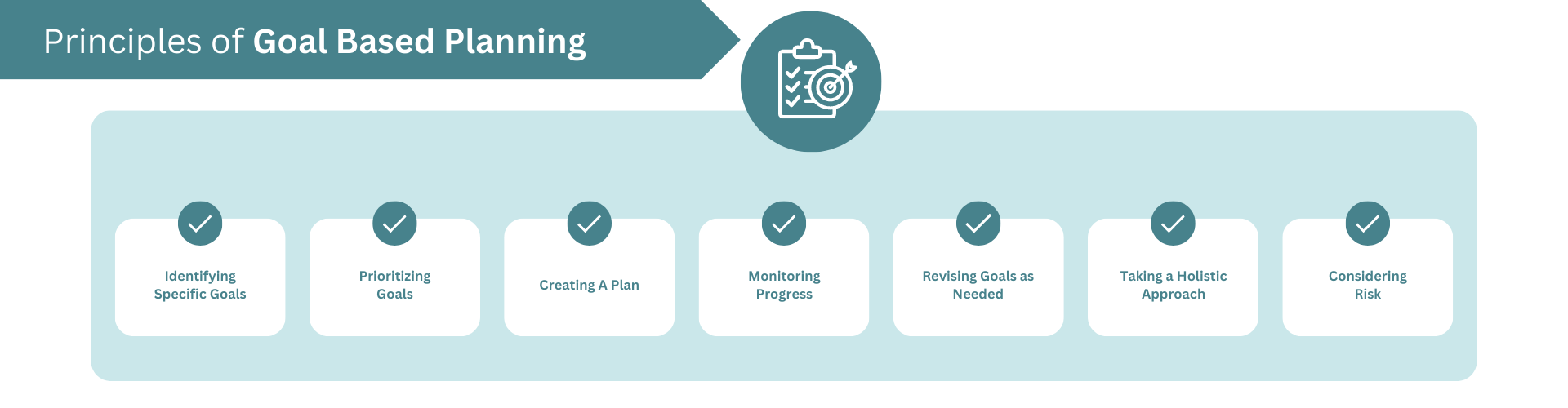

Goal Planning is the first step in successful goal achievement. It marks your first point toward success your vision.Goal planning is the process of setting specific objectives that you want to achieve in the future and creating a plan of action to make those objectives a reality.

Your goals will influence every financial decision from the asset class to invest, tenure of investment, etc. Financial goal setting involves a series of actions, from deciding your investing goals to actively taking and executing financial decisions to achieve your goals.